Process Tax

appeal against the tax notice is first act of the tax process.

appeal against the tax notice must be lodged before the competent Provincial Tax Commission.

appeal against the tax notice must be filed within 60 days from the date on which the taxpayer received a tax notice against which it occurs.

If the taxpayer has applied for a refund to which the Administration did not reply, you can appeal the tax notice after 90 days from the date of submission of the request until the right to refund is prescribed. In essence, it will take to form the so-called "silent rejection" when required by law.

appeal against the tax notice must be served first office that issued the contested measure (within 660gg above) by way of direct delivery

- ;

- by mail, by registered mail without an envelope and the receipt, by notification

- bailiff.

Within 30 days of notification to the office should be formed by depositing or transmitting the Provincial Tax Commission copies of the application .

Given that the process is a process mainly tax document, the applicant is required to set out and submit the detailed grounds of appeal and the counterparty is required to submit counter-arguments, che permettono al ricorrente di conoscere la strategia adottata.

ATTENZIONE

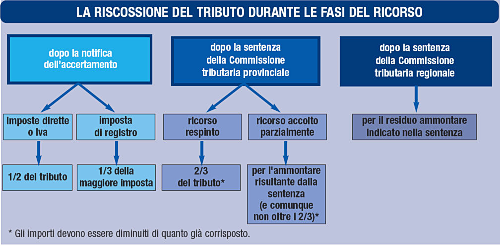

Il ricorso contro la cartella esattoriale non esenta dal versamento, anche se provvisorio e in alcuni casi parziale, delle somme richieste con l’atto impugnato (ad esempio, per le imposte dirette e per l’Iva è prevista l’iscrizione a ruolo della metà delle somme). Se il ricorso contro la cartella esattoriale viene accolto, il tributo corrisposto in eccedenza, rispetto a quanto stabilito dalla sentenza della Commissione, deve essere rimborsato d’ufficio, con i relativi interessi, entro 90 giorni dalla notifica della sentenza.

Esito del ricorso e applicazione della sentenza

If the outcome of the appeal against the tax notice is not favorable to the plaintiff, in cases where you plan to split the collection of the tax subject of the proceedings, the amounts owed with interest thereon, shall be paid as indicated in the statement below .

When you reach the final ruling of the tax process, and the same vote in favor of the taxpayer, the department must take action promptly, on time, (or, in the absence of a period within 30 days of circulation notice by bailiff) to perform the obligations under the same sentence.

If the office fails to comply with that determination the taxpayer may submit a further appeal to demand the execution of the sentence (review of compliance).

This application must be addressed to the President of the Commission that issued the res judicata and calling for compliance.

The payment of court costs

With the ruling that defines the view, the Tax Commission also decides the amount of court costs against the losing party. In special cases the Commission may decide to tax the costs among the parties to the proceedings.

0 comments:

Post a Comment